Optimism (OP) Price Enters Ideal Buying Zone: What’s Next?

The Optimism (OP) price shows signs of recovery, which could evolve into a significant rally if supported by investor confidence.

However, a formidable resistance looms ahead that might stall its progress before reaching $3.50.

Optimism Is Building Momentum

Following a notable correction aligned with broader market trends, Optimism’s price rebounds from the $3.00 support level. This downturn decreased market value, as highlighted by the Market Value to Realized Value (MVRV) ratio.

This ratio, which evaluates investor profits or losses, currently indicates a 30-day MVRV of -20% for Optimism, suggesting recent losses that could trigger investor accumulation.

Historical data suggest that OP’s recovery often begins within the MVRV range of -9% to -20%, deemed an opportunity zone. During such periods, investors are more inclined to hold onto their assets, creating a conducive environment for a potential rally.

As Optimism aims to retake $3.50 as a support level, the path to recovery is backed by significant potential profits.

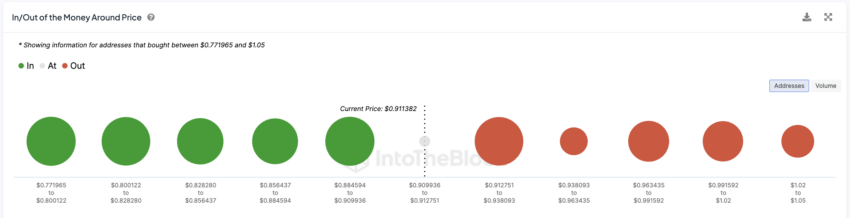

The Global In/Out of the Money (GIOM) indicator shows approximately $360 million worth of OP, spanning between $2.88 and $3.44, is poised to become profitable as the price climbs.

OP Price Prediction: Resistance

Optimism’s journey towards reclaiming $3.50 as support is promising, buoyed by the prospect of turning recent investments profitable. This optimism among investors is expected to reduce selling pressure, aiding the asset’s recovery.

However, the path is not without obstacles. A dense resistance zone above $3.44, where about 293 million OP, valued at over $925 million and purchased between $3.44 and $4.65, lies in wait. Overcoming this barrier will necessitate stronger bullish momentum.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

Should Optimism encounter difficulties in breaking through this resistance, the potential for profit-taking could trigger a pullback, potentially driving the price below the $3.22 support level and challenging the optimistic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.