Solana (SOL) Price Falls Below $100

The Solana (SOL) price has gradually fallen since reaching a high of $126 on December 15, 2023.

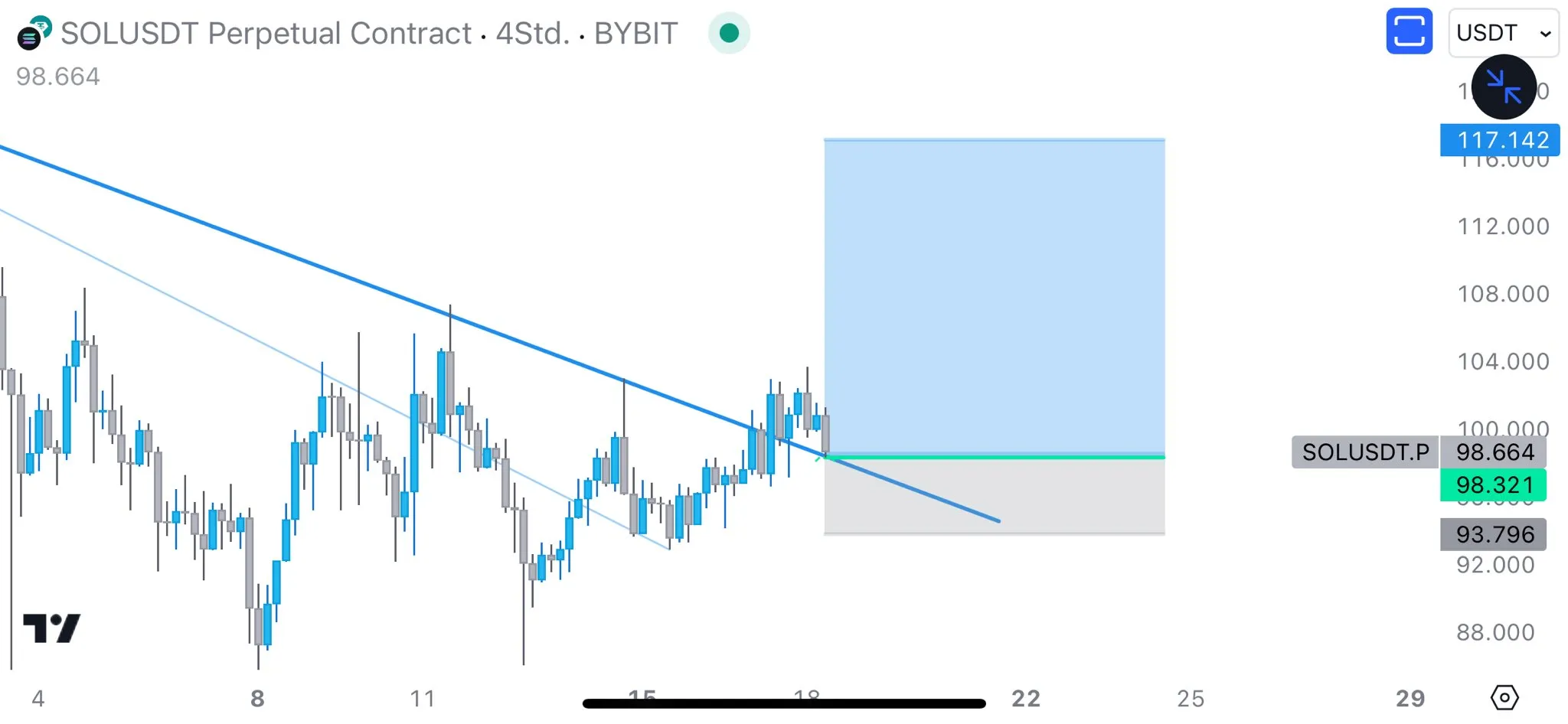

SOL broke out from a descending resistance trend line today but still trades inside a symmetrical triangle pattern.

Solana Attempts to Stop Bleeding

The technical analysis of the daily time frame shows that the SOL price has increased alongside a steep ascending support trend line since October 2023. The upward movement culminated with a high of $126 in December.

The price has fallen since, creating several long upper wicks (red icons).

Despite the decrease, the Solana price bounced at the ascending support trend line and trades above it. So far, the trend line has existed for 95 days.

The daily RSI leans bearish. The RSI is a momentum indicator traders use to evaluate whether a market is overbought or oversold and whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

The indicator generated a bearish divergence (green) before the drop. A bearish divergence occurs when a momentum decrease accompanies a price increase. It often leads to bearish trend reversals. The RSI has fallen since and trades right at 50.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

What do Analysts Say?

Cryptocurrency traders and analysts on X have a mixed view of the future trend.

MuroCrypto is bullish. He tweeted a breakout and retest, predicting that the price would increase.

Altcoin Sherpa believes the Solana price will fall, tweeting:

$SOL: still thinking this one goes lower overall but I’m going to just hold my bag for a bit. Bullish on this in 2024

However, Bluntz Capital is also bullish, noting the same breakout and retest as Muro Crypto as to why SOL will increase.

Read More: What is Solana (SOL)?

SOL Price Prediction: What to Make of the Price Movement?

A closer look at the six-hour time frame does not help determine the direction of the SOL trend since the price action shows mixed signs.

On the bullish side, the price action shows a breakout from a descending resistance trend line and its validation as support.

However, a short-term symmetrical triangle is also in place (dashed). The triangle often acts as a continuation pattern. Since it transpires after a downward movement, it will likely lead to a breakdown.

Additionally, the possibility of a SOL price breakdown aligns with the wave count.

Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology.

The most likely wave count suggests that the triangle is part of the B wave in an A-B-C corrective structure (white). Giving waves A:C a 1:0.618 ratio will lead to a low near $78.

This is close to the main horizontal support area at $75. A similar target is given by projecting the triangle’s length to the breakdown level. A decrease of 25% is required to reach it.

Despite the bearish SOL price prediction, a breakout from the triangle will mean the local bottom is in. Then, SOL can increase 18% to the next resistance at $117.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.